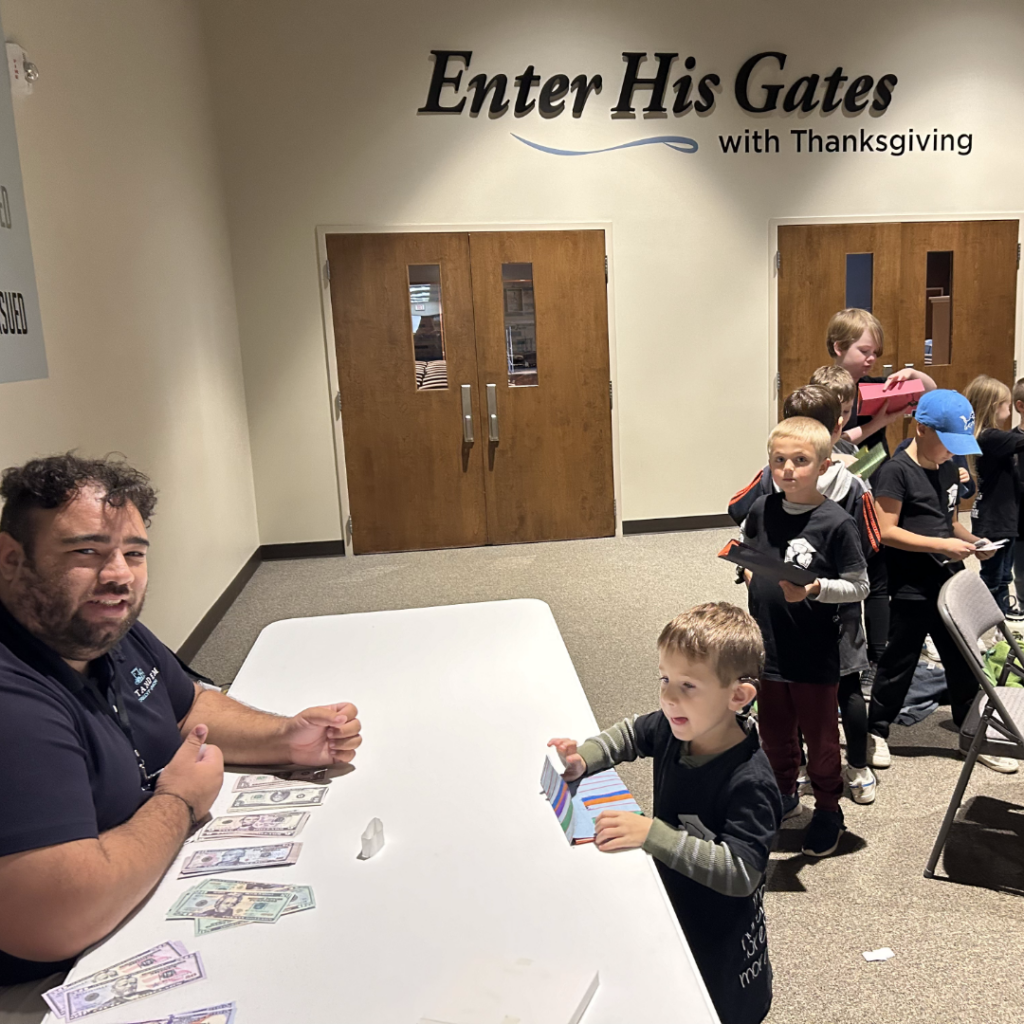

One of our Member Services Representatives, David, had the unique opportunity to visit a local homeschool co-op for their career class. It was a memorable day for David as he introduced a group of enthusiastic kids to important lessons about money and how credit unions work.

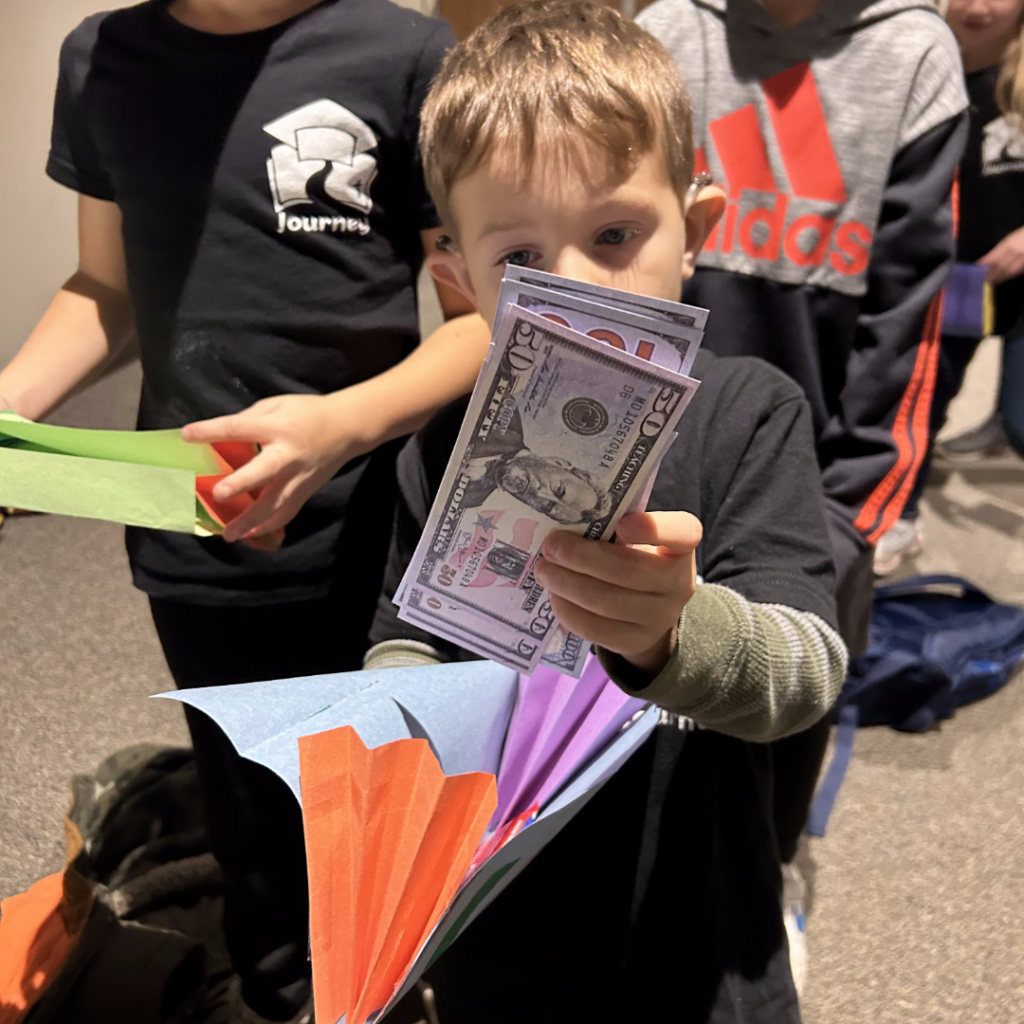

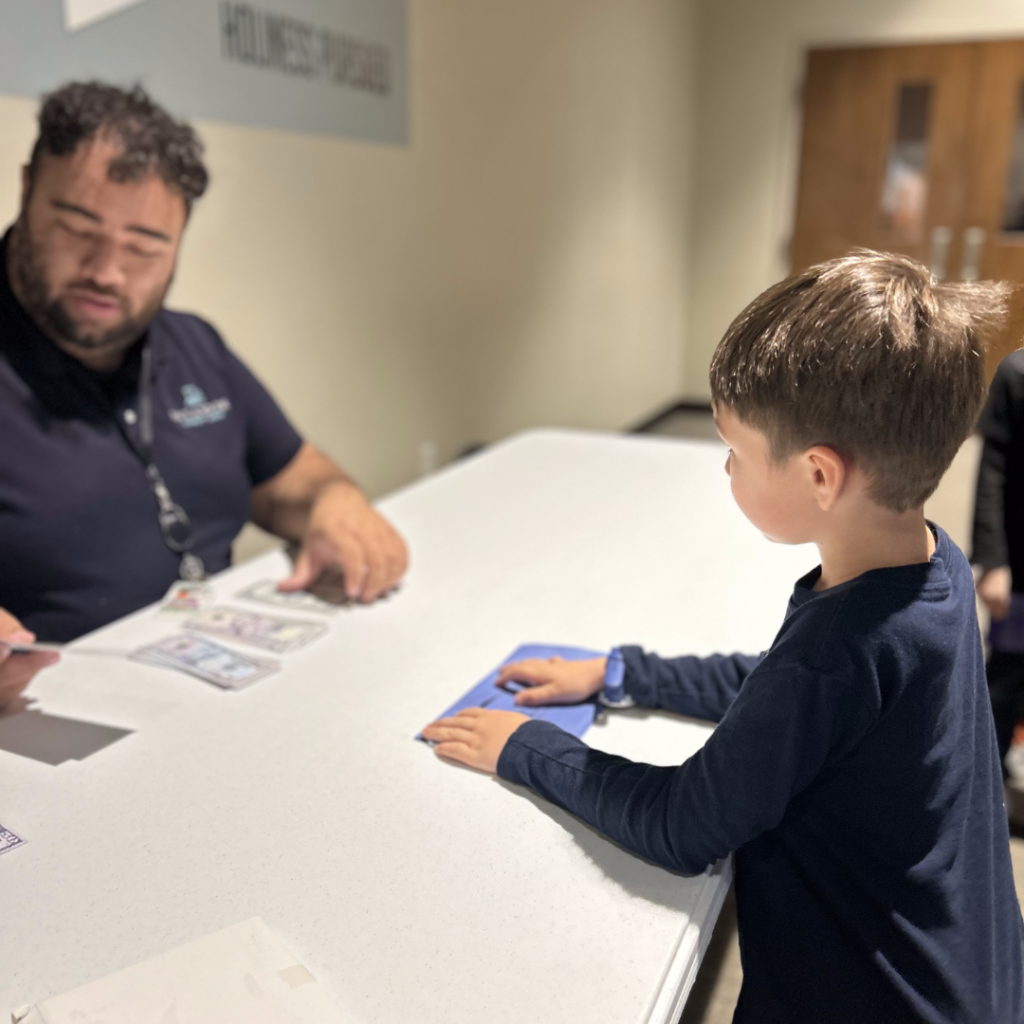

David transformed their classroom into a mini credit union, complete with a pretend bank. The kids lined up to “deposit” and “withdraw” money, getting hands-on experience with concepts like saving, spending, and budgeting. To make things even more fun, they made their own wallets, turning a craft into a practical lesson on keeping their money safe.

It wasn’t all about money and banking, though. David shared that he used to play football, which led to some funny moments when the kids assumed he had been in the NFL.

The day was filled with enthusiasm and learning. The students left with their handmade wallets and a better understanding of how money works. David walked away with unforgettable memories—and a good laugh about his brief brush with “NFL fame.”

Experiences like these remind us how important it is to engage with our communities and help young minds build financial confidence early on. Maybe one day, one of those kids will find themselves working in a credit union, just like David!